6-1.

Overview

Since currency is an integral part of trade, we’ll start with some terminology explanations and then delve into important points!

What You Can Gain from This Topic

- Exchange Risk

- Forward Contract

- Spot rate and Forward rate

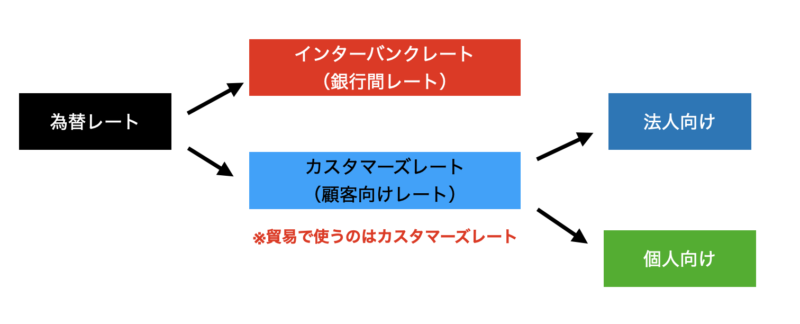

- Interbank rate and Retail rate

What is an Exchange Rate?

An exchange rate is the rate at which one currency can be exchanged for another.

In trade, deciding which currency to use is crucial when dealing with countries with different currencies. The U.S. Dollar is commonly used as the international currency.

Exchange Risk

Currency fluctuations in the foreign exchange market can result in exchange risk, which may cause financial loss or gain due to exchange rate fluctuations.

Fluctuation of Exchange Rates

The fluctuation of exchange rates refers to the continuous changes in the value of one currency about another. Exchange rates are influenced by various factors, including:

- Economic conditions

- Global situations

The fluctuation in exchange rates after the contract is signed often results in potential losses.

Case Study 1

The importer incurs a loss when the yen depreciates more than the exchange rate upon contract.

- Product Price: USD 1/pcs

- Quantity: 100 pcs

When the contract is made:

Exchange Rate: USD 1= 90 yen

Anticipated Payment Amount: 90 yen x 100 = 9,000 yen

When payment is made:

Exchange Rate: USD 1= 100 yen

Payment Amount: 100 yen x 100 = 10,000 yen

Loss: 1,000 yen

Case Study 2

If the yen appreciates beyond the exchange rate upon contract, the exporter will suffer a loss.

- Product Price: USD 1

- Quantity: 100 pcs

When the contract is made:

Exchange Rate: USD 1= 110 yen

Anticipated receive Amount: 110 yen x 100 = 11,000 yen

When payment is made:

Exchange Rate: USD 1= 100 yen

Payment Amount: 100 yen x 100 = 10,000 yen

Loss: 1,000 yen

Foreign Exchange Hedges

The exchange rate significantly influences profits, and predicting its movement is challenging. Therefore, Foreign exchange hedges are taken to minimize exchange rate risk.

Forward Contract

There are several types of foreign exchange hedges, but one of the most common is a forward contract (forward foreign exchange contract).

A forward contract secures a predetermined exchange rate for the future to mitigate the risk of currency fluctuations and ensure profitability.

Use Case

For example, the seller intends to export automotive parts to Thailand two months from now. The seller can arrange a forward contract at a rate of 1 USD = 130 JPY by calling the bank.

Even if the exchange rate changes to 1 USD = 110 JPY in two months, the transaction will still be processed at the agreed rate of 1 USD = 130 JPY.

- Forward rate: 130 yen

- The exchange rate on the settlement date: 110 yen

- Applied rate: 130 yen

If you arrange a forward contract at 1 USD = 130 JPY.

Even if the yen becomes remarkably weaker, like 150 JPY, you can still transact at the agreed rate two months later.

Types of Forward Contracts

The reservation methods are divided into the two types below, depending on the delivery timing.

- Fixed date delivery: Reserving the rate for a specific future date

- Optional delivery: Reserving a rate for a certain period and executing it during that period.