3-5. Incoterms D Group (DAP/DPU/DDP)

Overview

What You Can Gain from This Topic

- Review of Incoterms

- F Group Terms and Conditions

- How to Prepare an Invoice

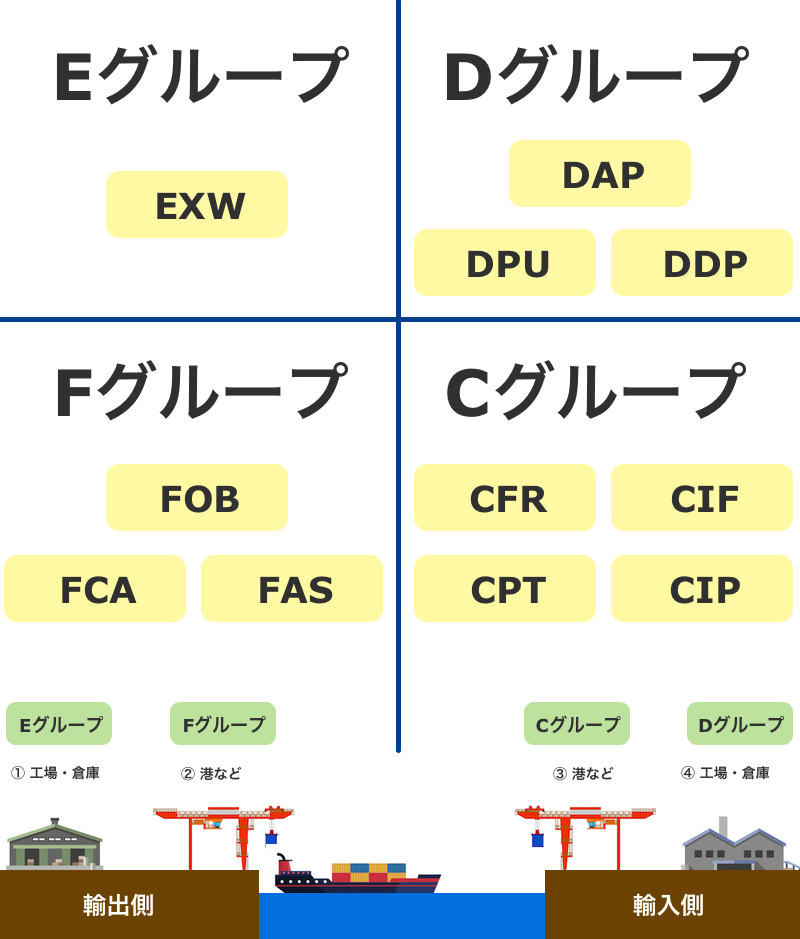

Review of Incoterms

As explained in the previous topic, Incoterms are broadly divided into four groups. In the D Group, the cargo is primarily handed over at the designated place of the importer.

D Group’s Characteristics

D Group has three trading terms as the following:

・DAP (Delivered at Place)

・DPU (Delivered at Place Unloaded)

・DDP (Delivery Duty Paid)

Differences between FOB, FCA, and FAS

Now, we will explain the delivery points of the three conditions of the D group. The key points to grasp the differences in each condition of the D Group are:

- Unloading location

- Customs arrangements

- Payment of taxes (duties and consumption taxes)

DAP

In DAP, the importer is responsible for unloading at the place of import. The importer is responsible for paying the customs clearance fees and taxes, including duties and consumption taxes.

DPU

In DPU, the exporter is responsible for unloading at the destination specified by the importer. The importer is only responsible for paying customs clearance fees and taxes, which include duties and consumption taxes.

DDP

Under DDP terms, the importer is responsible for unloading the cargo at the destination. However, all other costs and risk burdens are borne by the exporter.

When Group D is Used

Group D and Group E are the two opposite groups. The exporter pays most of the costs and risks, making DDP the most accessible trading term for the importer.

Group D is used in the following cases:

- Sample transportation

- Where the exporter is familiar with transport to a specific region

Sample Transportation

DDP is mainly used for small shipments, such as samples. In some cases, when the shipping cost is low, and the objective is to send the goods quickly, the exporter may choose to bear all the costs and send the goods.

Where the exporter is familiar with transport to a specific region

In Group D, the exporter handles trucking and customs clearance in the importing country. They often have a local partner familiar with transportation in a particular area.

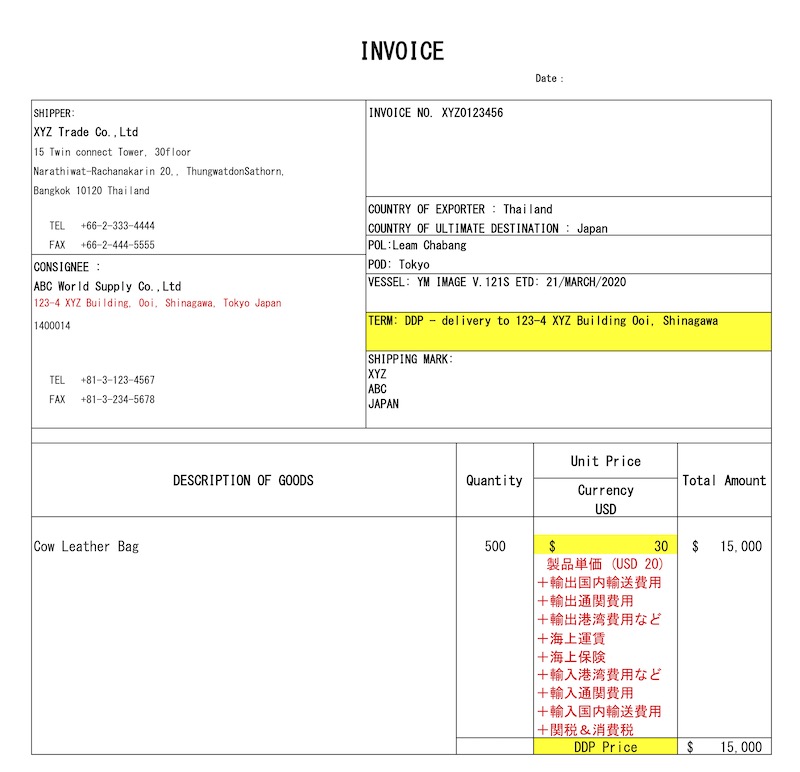

How to Prepare Invoice (DDP)

The unit price in DDP includes all transportation costs to the destination and taxes. In the “Term” section, DDP is specified, and the “Total Price” section notes the DDP price.

※ Please note that the description in red text is not necessary for practical work.

※ Please note that the description in red text is not necessary for practical work.

Summary

D Group conditions are less burdensome for importers. In the case of Delivered Duty Paid (DDP) terms, forwarders may temporarily cover the import duties. Whether they can handle it depends on the tax amount.

If you are proposed to transport under D Group, it is recommended that you consult with a forwarder beforehand.

Enhanced Learning with Videos

Test Yourself

Reinforce your understanding of this topic by working through the exercises. Attempting the exercises without referring to the material as much as possible is advisable.